The LCMS Giving Crescendo: Good Stewardship is Paramount

The largest transfer of wealth in LCMS history is already underway. Whether it secures our future or vanishes into decline depends on the choices we make in the next twenty years.

A demographic wave is cresting for the Lutheran Church—Missouri Synod (LCMS). Over the next 15–20 years, Baby Boom households — the most generous generation in our churches — will make decisions about their estates.

The stakes are high. Our average member age is about 56, which is a full decade older than the U.S. average. It is estimated that 47% of members are 65 years or older, and only 5% are between 18 and 29 years old. That means the Synod’s “giving crescendo” will arrive earlier and end sooner than the nation’s. Between 2035 and 2045, charitable inflows to LCMS institutions are expected to reach their highest levels in history. But after that, they will decline quickly and permanently.

The question is not whether the wave is coming, but whether we will ride it with wisdom or squander it in patchwork fixes that leave little behind to support Word and Sacrament Ministry when the Boomer wealth train is gone.

The prudent see danger and take refuge, but the simple keep going and pay the penalty.

Proverbs 22:3

Imagine a typical LCMS couple in their late 70s. They have supported their congregation faithfully for decades, raised their children in the church, and tithed beyond their local parish to schools, missions, and Synod. They benefited from an American economy that was structured very differently, enabling them to accumulate wealth and enjoy much higher levels of disposable income than their grandchildren can manage in 2025. Their children, however, are not deeply rooted in Lutheran life, and many have left the church and even rejected their faith. When the estate of their parents is settled, the congregation and Synod may receive a final, significant gift — probably the very last one from that household. Multiply this by tens of thousands of households, and you begin to see the scale. Between 2025 and 2070, LCMS-related giving could total nearly $2.7 billion in real 2025 dollars. With wise investing, that one-time windfall could grow into $7–$23 billion, depending on the strategy and discipline.

Three Imperatives for Stewardship

1. Reform Our Structures: Cut to Grow

The Synod cannot maintain every board, building, and program. The Boomer crescendo must be complemented by reform and consolidation, rather than being used to patch deficits and provide end-of-life care for chronically or even terminally ill institutions. Hard choices — such as asset sales, school rationalizations, and staffing cuts — must be faced before the wave crests, not after it recedes.

2. Refocus Our Mission: South and West First

The collapse of the demographic “Fortress Missouri” in the Midwest means the future of LCMS growth needs to be aligned with and prioritized in the South and West. Domestic missions must start to take precedence over foreign missions that have been relying on Missouri to prop them up with limited “return on investment”. This is not abandonment; it is long-term strategic survival that reverts resources to the people who made “international Missouri” possible, but that age has passed.

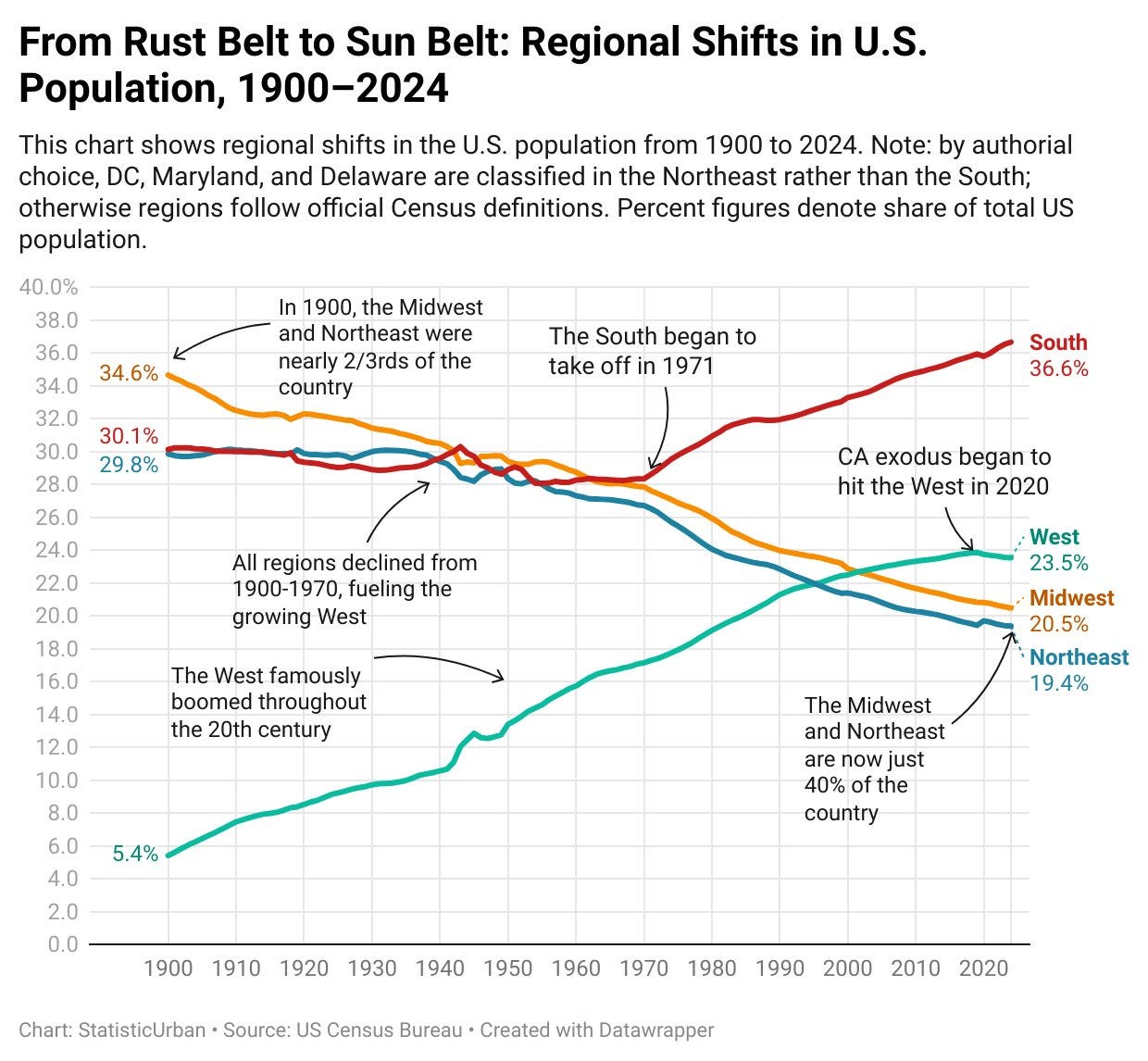

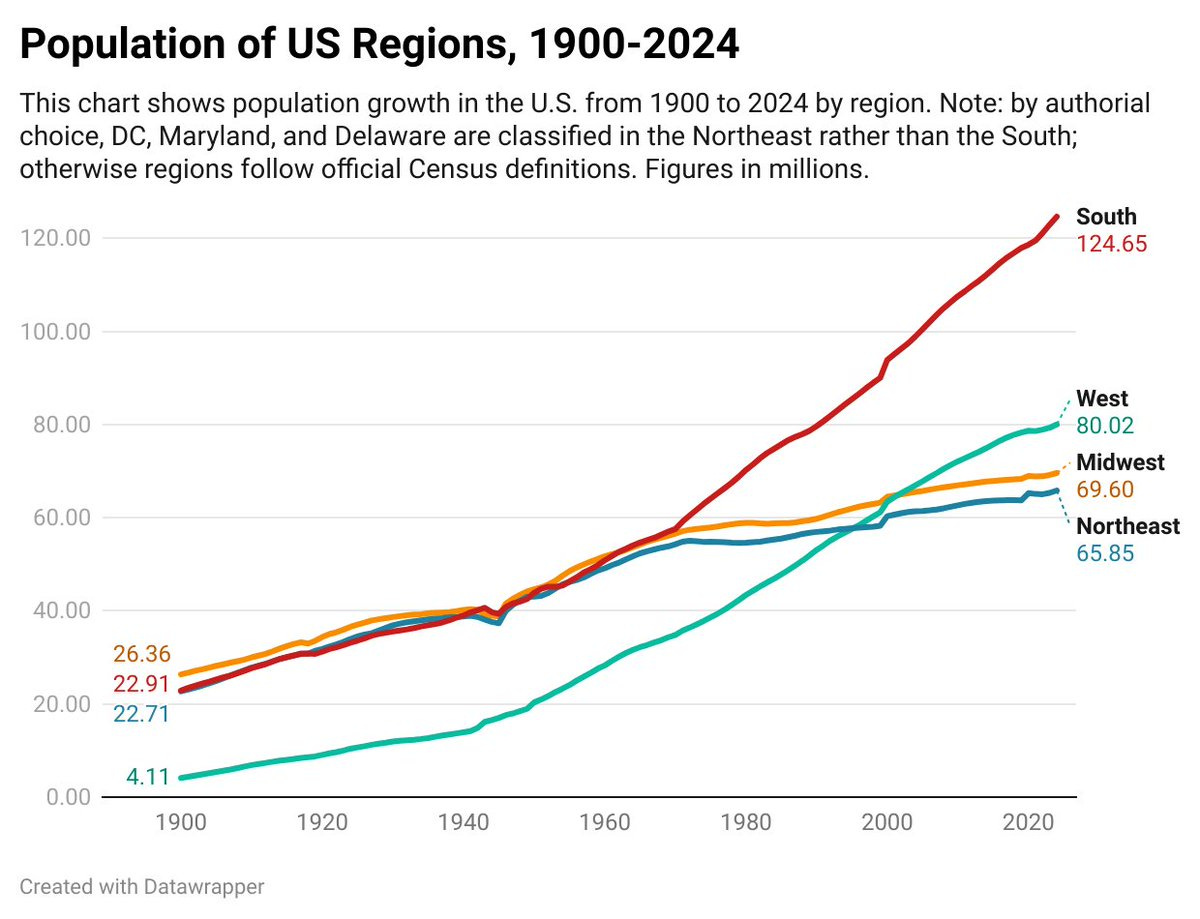

From Rust Belt to Sun Belt

The U.S. has been quietly reshaped over the last century. In 1900, the Midwest and Northeast made up nearly two-thirds of the nation. Today, they are down to just 40%. The South alone now accounts for over a third of the country’s population, while the West — once sparsely settled — has grown to nearly a quarter.

The Future Is South and West

Raw population growth tells the same story. Since 1970, the South has added over 70 million people, more than the entire current population of the Midwest. The West, despite recent outmigration from California, has quadrupled in population since 1900.

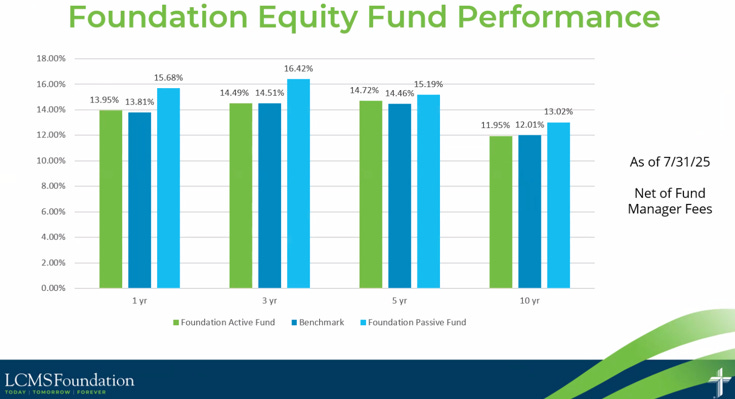

3. Reform Our Investment Strategy: Think 2070, Not 2025

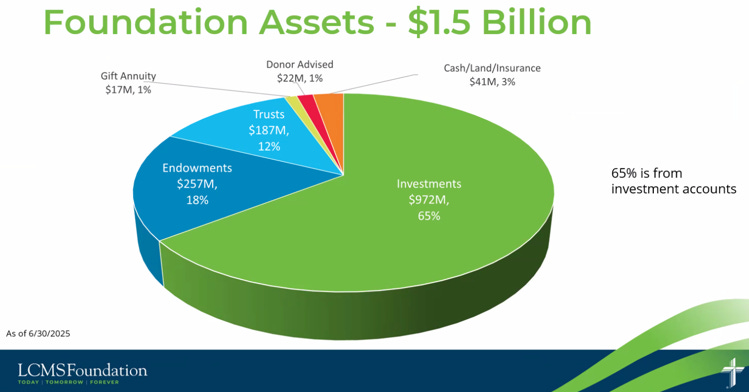

The LCMS Foundation has been a faithful steward, but current strategies probably need to be upgraded or revisited to match the scale of the opportunity. Compare our position with that of the Latter-day Saints: they have amassed nearly $300 billion through long-term, disciplined, and diversified investments in real estate (2.3 million acres held in the US!), bonds, equities, and private equity.

By comparison, even an optimistic LCMS scenario yields $20 billion by 2070 (excluding existing funds, which total around $1.5 billion). That may seem small next to LDS reserves, but it is enough — if disciplined — to sustain the most critical functions for generations. We cannot be content to be caretakers of decline - there must be a Synod-wide refocus on the long-term future (30 years plus)

Telling the Story in Charts

Figure 11

Living giving has already flattened and will decline steadily.

Bequests rise sharply, cresting around 2040–2042.

Total giving peaks at $100–115 million annually, then falls quickly after 2045.

Figures 2 & 3. Cumulative LCMS Foundation inflows, 2025–2070

Raw cumulative inflows: $2.7 billion (real 2025 USD).

Compounded at 3%, 5%, 7% real: $6.6 billion, $12.2 billion, $22.9 billion respectively.

With a $250M infusion from asset sales, rationalization, and consolidation (2025–2039), totals could rise to $26.3 billion.

By 2070, a $20 billion LCMS portfolio could reasonably generate $600–800 million/year in sustainable dividends and interest (real 2025 USD), with a conservative floor around $400 million and an aggressive ceiling around $1 billion . That is more than enough to sustain a Synod, its pastors, churches, schools, and colleges completely reversing the traditional funding model.

A Small Window

The LCMS has perhaps two decades to reset itself for post-Boomer generosity. After 2045, the demographic wave recedes and, with it, the options and flexibility the Synod enjoyed for over a century vanishes. This is not an argument for fear, but one for better stewardship. We must:

Say “no” more often, ending programs that drain resources without advancing the mission.

Invest wisely, diversifying more for long-term sustainability.

Teach and encourage generosity, without exploiting heirs by depriving them of their inheritance and creating bitterness towards Christ’s Church.

The center of gravity was in St. Louis, Chicago, Minneapolis, Detroit, and the rural Midwestern bulwark. That era is gone, and we have to come to grips with a church that is centered in Texas rather than Missouri.

☩TW☩

Key projection assumptions:

Based on LCMS Inc. and LCMS Foundation reports.

LCMS Membership declines at -2.23% CAGR per year.

Long-term average inflation of 2.5% per year.

LCMS average membership age ~56 years in 2025.

With the idea of Texas and the south being our center going forward we need to focus on making those districts solid. The Texas District and the Southern District are complete dumpster fires. Florida-Georgia probably isn't much better but they don't make the headlines. Written by a member of an English District congregation in GA so I should know more but I do not.

I ask you what will be done to guarantee the orthodoxy of the LCMS, going forward. I think of faithful Episcopaliansn Presbyterians, and even those who made bequests to what are now ELCA congregations. Their bequests are now being used by apostates and heretics. Even the LCMS had its Seminex and currently the Concordia Texas fiasco. How do faithful Christains guard against their bequests ending up in the hands of heretics?