You Must Pay Attention to USD Stablecoins

A quiet financial revolution is underway that will affect the way you handle and manage money.

Jesus had a lot of fun with fish and money during his earthly ministry. The piscene references all seem to point to God’s unlimited abundance and provision for His creation. A particularly interesting story is Jesus relying on a fish to find and deliver a coin to pay the temple tax for Himself and Peter (2 drachma each, Matthew 17:24-27). Lo and behold, it was a type of ultimate stablecoin—a fixed amount of gold and silver (a half shekel, or 2.5 day’s wages)—that held the same value for ~1478 years, from its institution in Exodus 30:11-16 and Exodus 38:26.

While the temple tax coin was tangible and divinely demanded, today’s ‘coins’ are digital and anchored instead in our shifting secular desires, but they share a need for stable value and trust in exchange. Hence, we are neck deep in a radical evolution of traditional finance (TradFi), even though most people don’t realize it. Digital tokens are replacing and remaking our understanding of money and transactions, and the recently passed GENIUS Act has formalized and codified the revolution. The act creates the first comprehensive U.S. framework for payment stablecoins—privately issued, dollar-pegged digital IOUs backed by cash and short-term U.S. Treasury securities.

We’re on the cusp of a new era in which everyday assets like US Treasury bills will serve as the “real money” backing stablecoins, ensuring they’re as trustworthy as cash. This shift is transforming how money works—making it faster, cheaper, and always-on for people like farmers selling crops or workers cashing paychecks. It’s like when the US dollar became the world’s go-to currency after World War II, combined with the 1980s fintech boom that remade finance global but layered it with complex, inefficient “settlement” processes. Now, we’re heading to fully digital transactions that operate open 24/7/365 with settlements in microseconds, and the implications for continued American hegemony in international monetary relations should not be underestimated.

Key concepts to understand

What is a blockchain?

A blockchain is a shared, distributed ledger that records transactions across a network of computers. Each new record, or block, is cryptographically linked to the previous one, creating an immutable chain of data (a perfect audit trail that has almost zero risk for fraudulent assets or transactions). Because no single party controls it, a blockchain allows participants to transfer value or verify ownership directly, without relying on a central intermediary like a bank.

What is a payment stablecoin?

A payment stablecoin is a digital IOU that promises one U.S. dollar on demand. To keep that promise credible, the issuer holds reserves—typically bank deposits and short-term U.S. Treasury bills (T-bills)—equal to the number of tokens outstanding, and it publishes disclosures so users can verify backing.

What are RWAs? Why do they matter?

Real-world assets (RWAs) are traditional financial instruments (like T-bills) represented on a blockchain or held off-chain in custody to back on-chain tokens. For payment stablecoins, RWAs are the ballast: they make “one token = one dollar” believable and trustable.

How does redemption work?

A holder returns the token to the issuer (or an approved custodian) and receives $1 (or another token if they prefer) by wire or bank transfer. If reserves are transparent and liquid, redemptions are fast and orderly; if not, “run” dynamics can appear.

What the GENIUS Act does

The Trump administration has aggressively shifted the U.S. government's position on decentralized finance (DeFi) and tokenization across multiple levels by pushing through the GENIUS Act. Private stablecoins had grown into a shadow payments system, moving hundreds of billions of dollars daily and totaling an estimated $300 billion today. The goal of GENIUS is to legalize and discipline it.

Scope & Definitions: Establishes a federal regime for payment stablecoins (used for payments/settlement and redeemable 1:1 in dollars).

Who May Issue: Limits issuance to authorized U.S. entities (and qualifying foreign issuers under strict conditions).

Reserves: Requires 1:1 high-quality, liquid reserves (cash, T-bills, repos, and hard assets like gold for diversified issuers such as Tether, which holds 5% of its reserves in bullion, amid 2025’s gold surge to ~$4,100/oz). Segregation from the issuer’s own assets is also required.

Disclosures & Attestations: Regular public reports on reserve composition, location, and redemption performance.

Supervision: Assigns federal oversight, with space for qualified state supervision; clarifies roles among prudential regulators.

Bankruptcy Waterfall: Gives token-holders senior claims on the reserve pool if the issuer fails.

Implementation Timeline: Staged effective dates tied to final rules; transition periods for wallets/exchanges to handle only approved payment stablecoins.

The Act aims to treat payment stablecoins as a payments utility, not as speculative securities—hence the emphasis on reserves, redemptions, and consumer protection.

Why not “just dollars”?

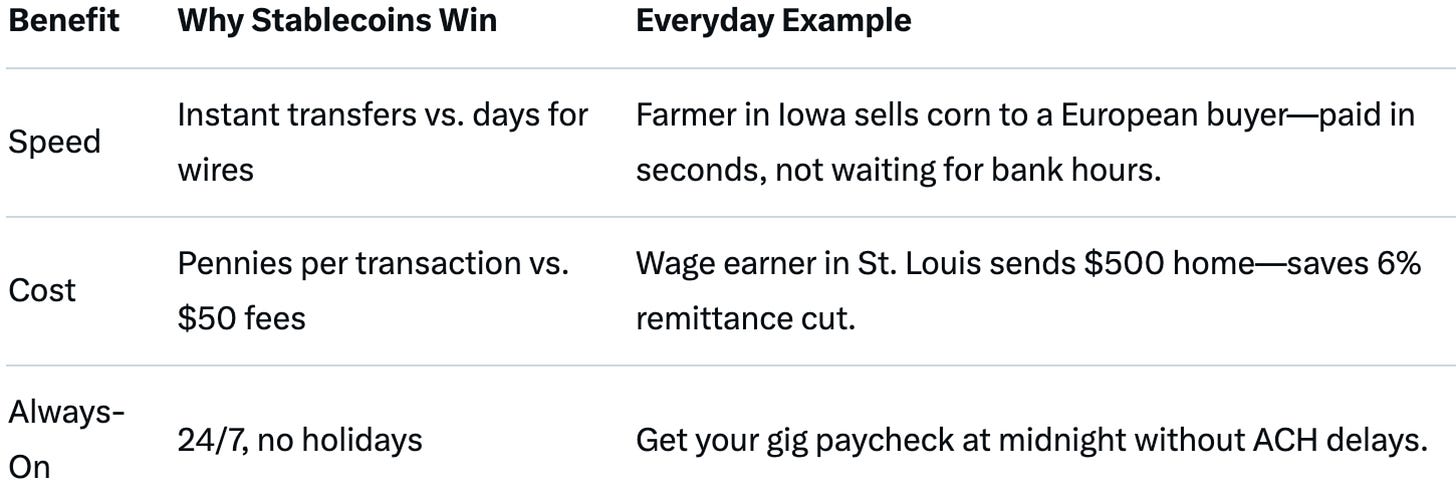

Table A — Functional Benefits: What stablecoins do that bank dollars do not

Table B — Why some users hold stablecoins rather than bank balances

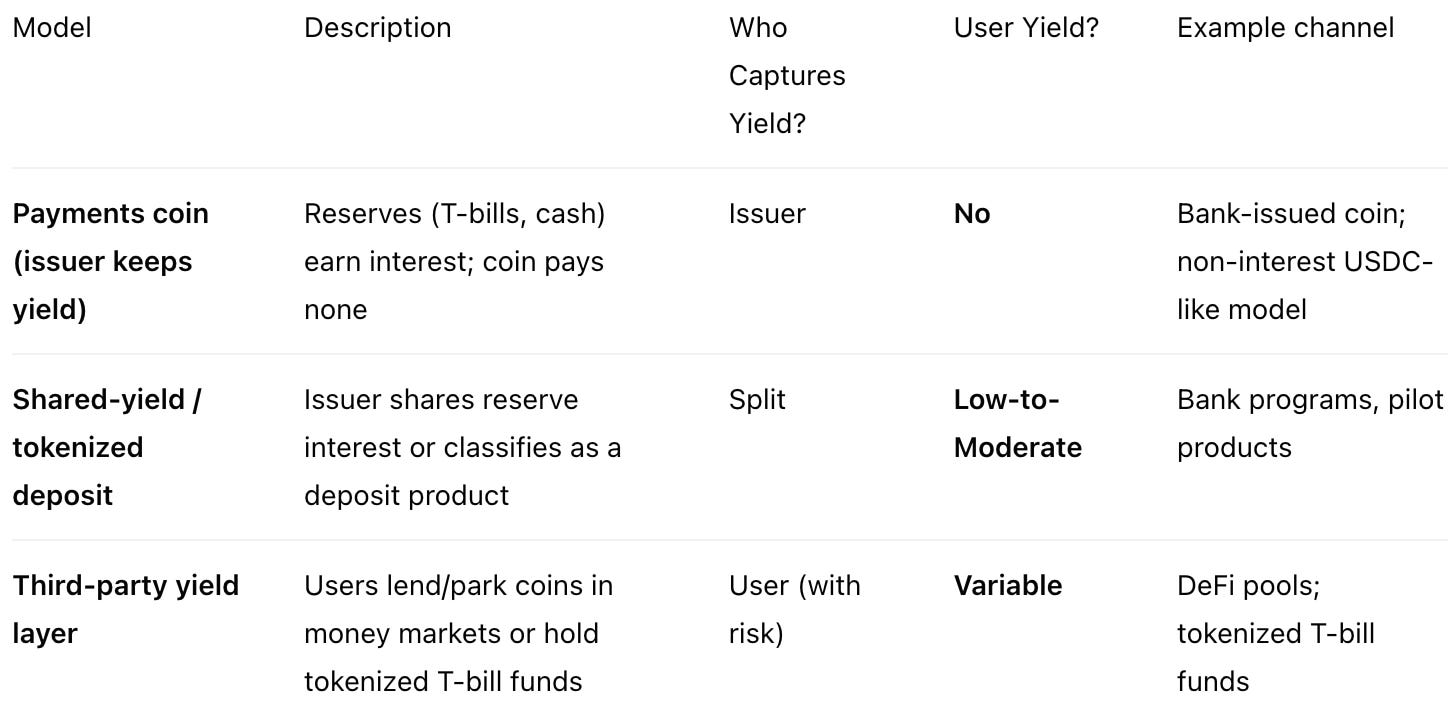

Yield: who gets it

Table C — Three Yield Models

Payment coins usually pay 0% to remain compliant and straightforward. Users seeking yield migrate to tokenized T-bill products or lending markets, accepting added risk.

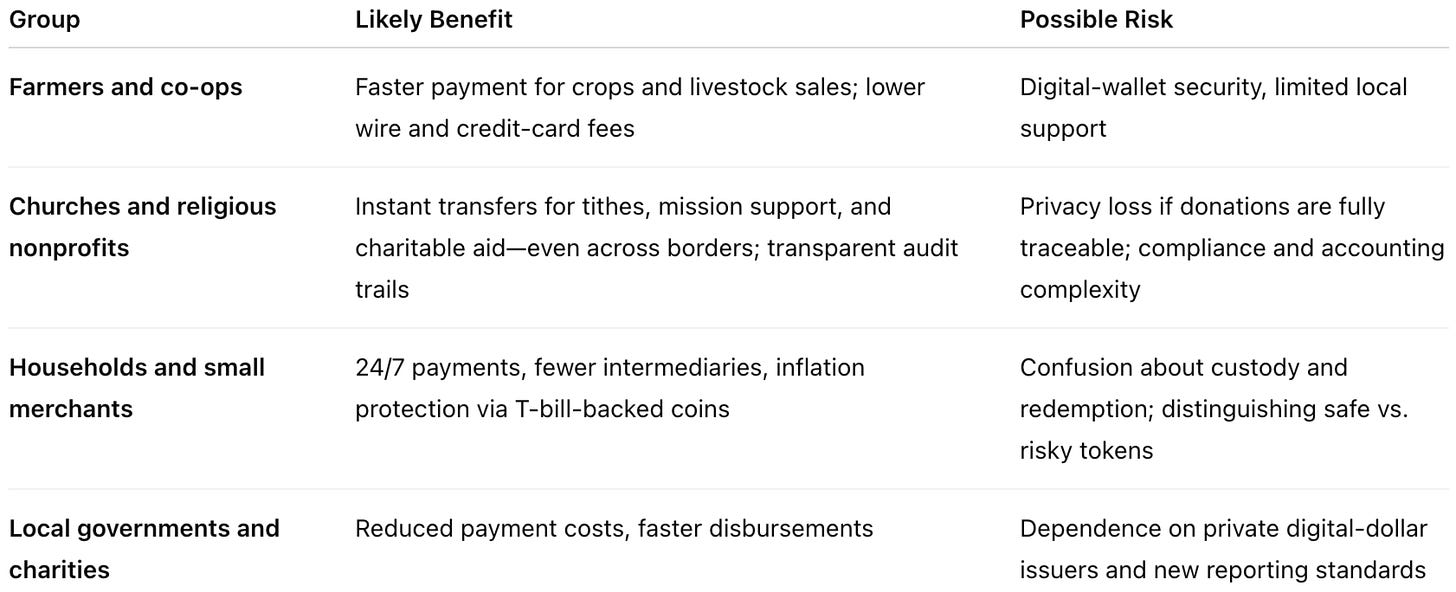

What it means for you

If all of this still sounds distant and ridiculously complex, here’s what it looks like on Main Street.

A farmer in Iowa:

Imagine you’re selling corn to a grain buyer in another state. Instead of waiting two business days for a wire or losing 3% to card processors, you could be paid instantly in a digital dollar backed by U.S. Treasuries, cash that settles before you leave the grain silo.

If your co-op uses stablecoin-based payments, it can hold value overnight in U.S. Treasury-backed digital tokens, earning a safe yield instead of sitting idle in a checking account that pays almost nothing.

A pastor in Minnesota:

Church treasurers won’t need to wait for bank transfers to clear or pay extra for cross-border mission giving. Stablecoins can move funds internationally in seconds, reaching the missionary’s wallet directly —not days later, after fees.

On the other hand, every transaction is traceable, and some small institutions may find compliance burdens higher than before.

The “Digital Dollar Flywheel”

U.S. T-bills and cash sit at the center of the new money ecosystem. Authorized issuers ‘tokenize’ that backing into payment coins. Coins circulate globally (exchanges, wallets, commerce). Some coins flow into tokenized T-bill funds, attracting more capital back to Treasuries. The cycle increases baseline demand for USD assets, while programmable rails expand usage. Regulation locks the loop into the U.S. legal perimeter.

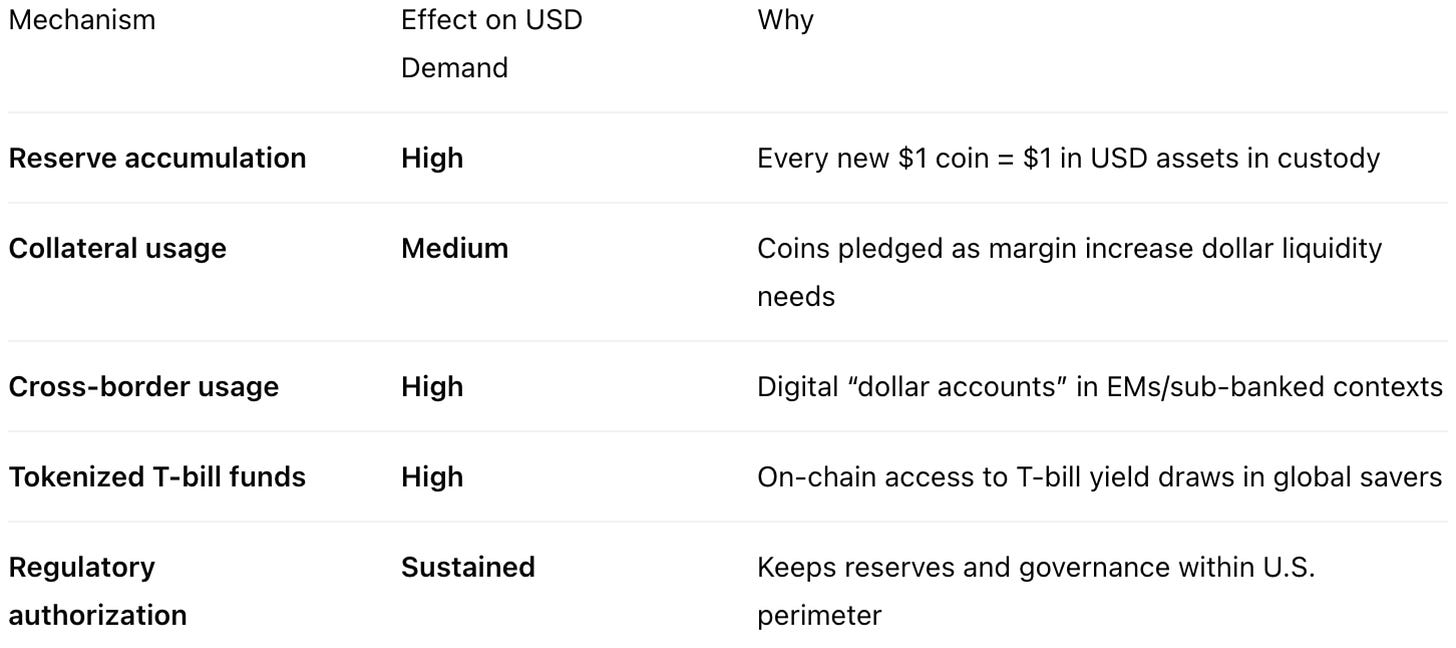

Table E — How stablecoins manufacture new USD demand

From gold bits to binary bits

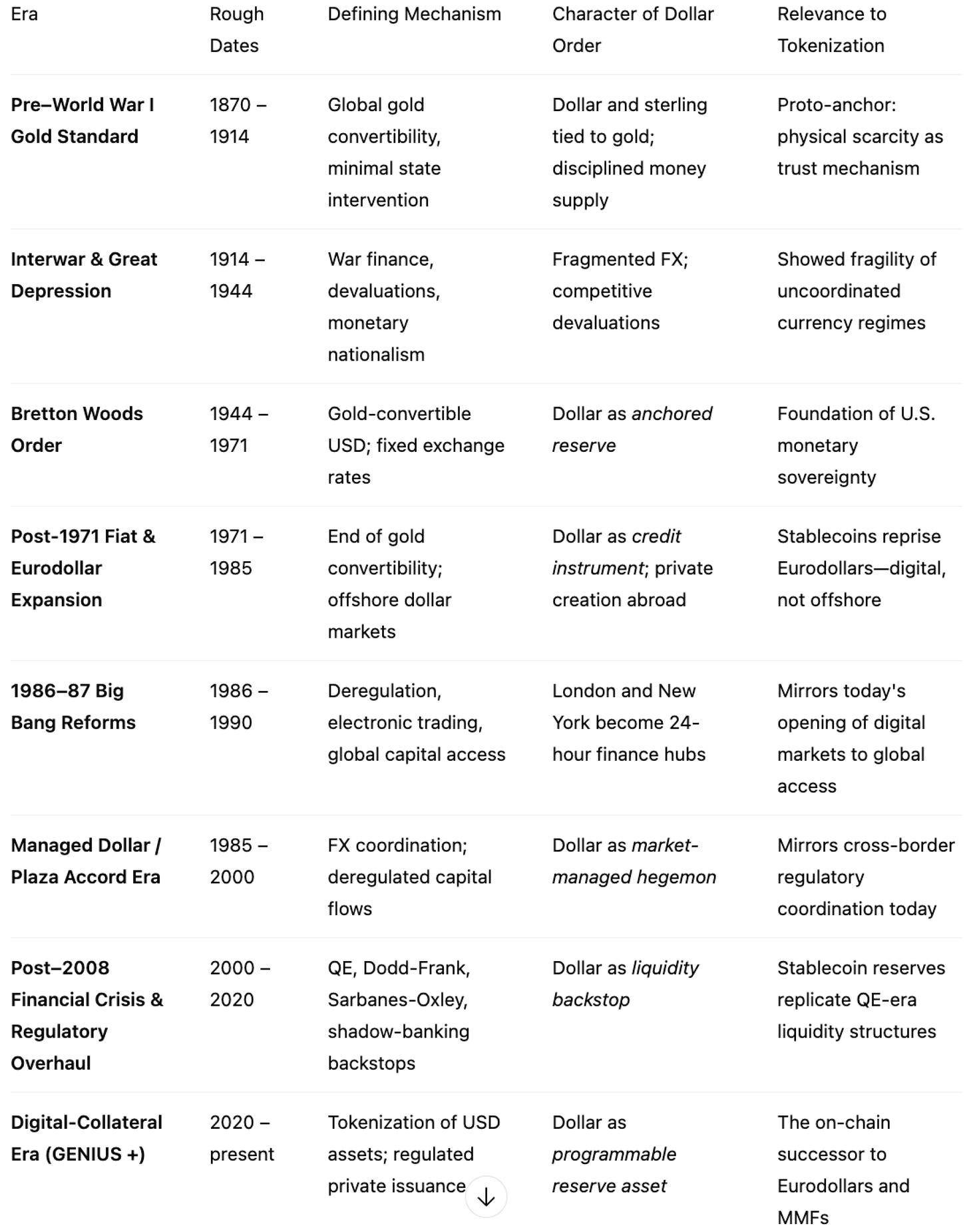

To see where we are in the never-ending arc of monetary innovation, Table F maps eight recent major eras—from the gold standard to today’s digital-collateral regime—showing how each shift redefined what backed the dollar and who governed it.

Table F — Recent Monetary Epochs

The digital-finance era doesn’t abolish the dollar order; it entrenches it. Each stage replaced what backed the dollar (gold → credit → regulation → code) while preserving who controlled its gravity (U.S. institutions).

Distributional effects (who wins what)

Issuers capture the reserve yield on non-interest-bearing payment coins; they gain client “stickiness” and data/network effects.

Users capture utility (speed, programmability, 24/7 reach). If they want yield, they use tokenized T-bill or lending layers (with corresponding risks).

The dollar system gains a new demand base and distribution channel: every coin backed by T-bills/bank cash increases embedded demand for U.S. assets.

What we know vs. what we don’t

Knowns

Payment-coin design centers on 1:1 reserves, redemptions, and transparency.

Direct yield on payment coins is typically 0% by design.

Tokenized T-bill products provide a separate yield lane for users.

Adoption increases structural demand for USD assets and 24/7 rails.

Unknowns (currently - regulatory updates expected in 2026)

Exact reserve eligibility, disclosure cadence, and stress-testing.

Liquidity backstops (if any) for orderly wind-downs or runs.

Cross-border recognition and treatment of foreign issuers.

Interoperability standards and concentration safeguards.

Conclusion

Whether you ever buy a stablecoin yourself or not, your dollars will soon move across these new digital rails. The GENIUS Act doesn’t just regulate crypto; it changes the plumbing to and from your checking account. Money has always been a matter of trust — and whoever defines the rails ultimately establishes the culture that runs on them. And never forget:

Luke 12: 32 “Fear not, little flock, for it is your Father’s good pleasure to give you the kingdom. 33 Sell your possessions, and give to the needy. Provide yourselves with moneybags that do not grow old, with a treasure in the heavens that does not fail, where no thief approaches and no moth destroys. 34 For where your treasure is, there will your heart be also.

"USD stablecoin" means the same thing as "CBDC". It only gets worse.

https://unlimitedhangout.com/2025/08/resources/show-notes/the-paypal-presidency-part-iv-teaching-technocracy/